AFP

Jan 28, 2011

Record-breaking gold boosted by eurozone crisis in 2010

AFP

Jan 28, 2011

Jan 27 - Gold prices smashed record peaks in 2010, jumping 29 percent on the back of robust demand, as the eurozone debt crisis boosted the safe-haven commodity, the World Gold Council said Thursday.

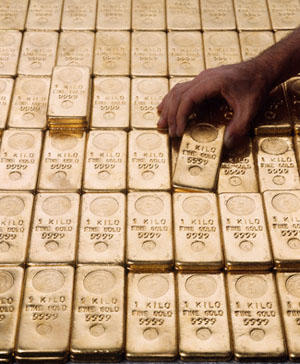

Gold bars from the mine of Kinross, South Africa |

The precious metal hit a record $1,431.25 per ounce on December 7, helped also by particularly strong jewellery demand from India and keen investment buying from China, said the WGC, which represents the gold industry.

However, the metal has since slipped back amid growing doubts about the strength of the worldwide economic recovery and stood at $1,334.50 at the afternoon fixing on Thursday.

"Gold benefited from the continued contagion from European sovereign debt problems as investors hedged their currency risk," said the WGC in its annual report.

"This was evidenced by strong gold buying in ETFs, bars, coins and other investment vehicles in Europe and other parts of the world."

Exchange traded funds (ETFs) allow traders to invest money more easily in commodities, without trading on the futures market. They are traded like shares and are widely regarded as an inexpensive and low-risk way of investing.

The WGC said Thursday that investors bought 361 tonnes of gold via the ETFs last year. That brought total ETF holdings to a record high 2,167 tonnes, worth the equivalent of $98 billion.

The glamorous metal rose for a 10th successive year in 2010, it added.

"A combination of global macro-economic conditions and favourable supply and demand fundamentals continued to drive gold's strong price performance in 2010," said WGC investment research manager Juan Carlos Artigas.

"Investors also continued to buy gold, a foundation asset that bears no default risk, in part to express an increasing sensitivity to the possibility of a tail-risk event involving sovereign debt as well as ongoing concerns over systemic risk.

"Gold's relatively low volatility and lack of correlation to many assets has made it an ideal candidate for portfolio diversification and risk management strategies."

In a further twist, the WGC noted that the world's central banks became modest net buyers of gold last year, following two decades as a "steady source" of gold sales.

The industry organisation meanwhile stressed that gold prices have only witnessed a "modest pullback" from striking December's record.

Copyright © 2024 AFP. All rights reserved. All information displayed in this section (dispatches, photographs, logos) are protected by intellectual property rights owned by Agence France-Presse. As a consequence you may not copy, reproduce, modify, transmit, publish, display or in any way commercially exploit any of the contents of this section without the prior written consent of Agence France-Presses.